Income Statement: How to Read and Use It

Simply put, this is the money a business or company earns by offering services or goods. For a manufacturing company, operating revenue will be the money earned on selling the final product. For a company offering subscription or consulting services, operating revenue will be the fees earned for services rendered. Once you take your total revenue and subtract your COGS, you get your gross profit. It’s the amount you take home before taking into account other, indirect expenses. A balance sheet tells you everything your business is holding on to at a particular point in time—your assets and liabilities.

- These denote costs linked to the goods and services offered by a business, such as rent, office, supplies etc..

- The statement displays the company’s revenue, costs, gross profit, selling and administrative expenses, other expenses and income, taxes paid, and net profit in a coherent and logical manner.

- Depreciation and amortization are non-cash expenses that are created by accountants to spread out the cost of capital assets such as Property, Plant, and Equipment (PP&E).

- Reducing total operating expenses from total revenue leads to operating income of $109.4 billion ($245.1 billion – $135.7 billion).

- The non-operating section includes other income or expenses like interest or insurance proceeds.

What is the difference between an income statement and a balance sheet?

We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own. All three documents must be reviewed together to get a clear picture of the financial health of the business. Income statements can be complex, but understanding the different components is crucial to interpretation.

Income statements, also called profit and loss or P&L statements, are one of the most important financial statements for tracking your company’s revenue and growth. Public companies are required to issue an income statement, along with the balance sheet and cash flow statement, every quarter. average payment period The income statement is one of the three important financial statements used for reporting a company’s financial performance over a set accounting period. The other two key statements are the balance sheet and the cash flow statement.

Harvard Business School Online’s Business Insights Blog provides the career insights you need to achieve your goals and gain confidence in your business skills. Access and download collection of free Templates to help power your productivity and performance.

Ultimately, horizontal analysis is used to identify trends over time—comparisons from Q1 to Q2, for example—instead of revealing how individual line items relate to others. Horizontal analysis makes financial data and reporting consistent per generally accepted accounting principles (GAAP). It improves the review of a company’s consistency over time, as well as its growth compared to competitors. An income statement is a vital tool in financial reporting and one of the most common and critical statements you’re likely to encounter. As a working professional, business owner, entrepreneur, or investor, knowing how to read and analyze data from an income statement—one of the most important financial documents companies produce—is a critical skill to have.

Secondary-Activity Expenses

Multi-step income statements are one of three types of income statement. Learn how to read income statements, and you’ll unlock the ability to understand guide to taxes on dividends your finances. When a business owner makes an income statement for internal use only, they’ll sometimes refer to it as a “profit and loss statement” (or P&L). Income statements are important because they show the overall profitability of a company and help investors evaluate a company’s financial performance. Income statements can also be used to make decisions about inorganic or organic growth, company strategies, and analyst consensus.

Income Statement Items Explained (With Examples)

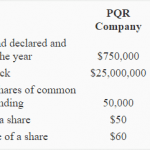

They are mostly made from one-time non-business activities that might not re-occur in the future. For instance, these could be assets accrued from the sale of land or an old vehicle. It is a statement prepared by companies that operate globally offering a wide range of products and services and consequently incurring an array of expenses. Given the nature of their operations, such entities have a complex list of activities and costs to account for.

Organization

While the balance sheet provides a snapshot of a company’s financials as ledger of a particular date, the income statement reports income through a specific period, usually a quarter or a year. While not present in all income statements, EBITDA stands for Earnings before Interest, Tax, Depreciation, and Amortization. It is calculated by subtracting SG&A expenses (excluding amortization and depreciation) from gross profit. This statement is a great place to begin a financial model, as it requires the least amount of information from the balance sheet and cash flow statement. Thus, in terms of information, the income statement is a predecessor to the other two core statements.

To this, additional gains were added and losses were subtracted, including $257 million in income tax. Because of how complex the operations involved in a multi-step income statement are, operating revenues and operating expenses are separated from non-operating expenses and revenues. Moreover, Losses and Gains are not usually recorded as such in this kind of statement but fall under one of the above categories. Your total revenue is all the money that has come into your business. As you move down your income statement, you’ll see that amount chipped away, used to pay for the cost of creating your products or services and keeping your company running.