How to find transposition errors in a trial balance American Institute of Professional Bookkeepers

Transpositional errors, which tend what is one way to check for an error caused by transposed numbers? to occur in accounting firms, brokerages, and other financial services providers, fall under the broader category of transcription errors. To further enhance the accuracy of data analysis and correction, adopting a collaborative approach can be beneficial. Seeking input from colleagues or subject matter experts can provide fresh perspectives and help uncover errors that may have been overlooked. Peer review and feedback sessions allow for the collective scrutiny of the data, ensuring that transposition errors are identified and corrected comprehensively. Additionally, involving multiple individuals in the correction process reduces the likelihood of personal biases or oversights.

Ask a Financial Professional Any Question

Additionally, manual verification provides an opportunity to detect other types of errors or inconsistencies that may have been overlooked. For instance, in a financial report, a transposition error may be accompanied by an incorrect currency symbol or an inconsistent decimal placement. By carefully examining the data, these errors can be rectified, contributing to the overall accuracy of the analysis. Ignoring transposition errors in data analysis can lead to misinterpretation of trends, inaccurate forecasting, compromised data integrity, and costly rectification efforts.

Why Running Data Analytics for Your Business’ Accounting Feels Overwhelming

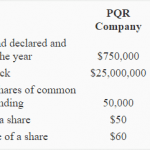

A bank reconciliation compares your accounting records to your bank statement. During the process, match every transaction to source documents, such as receipts and invoices. In math, transposition errors are the result of a person mistakenly recording two adjacent digits in the wrong order. The difference between 986 and 968 is evenly divisible by nine, which indicates the transposition error. In this example, the wrong number will be evenly divisible by nine, and the correct number will be 36.

Avoiding Transposition Errors

- Transposition errors can occur when you’re writing down two numbers or a sequence of numbers (e.g., 2553 vs. 5253).

- A transposition error refers to switching two of the digits in an accounting entry.

- For example, if you switched the 4 and the 6 in the number 2,460 the result would be 180 more, and that’s exactly what you need to get your totals to agree.

- To further enhance the accuracy of data analysis and correction, adopting a collaborative approach can be beneficial.

- Transposition errors affect the aorta and pulmonary arteries, which are both major blood vessels that leave the heart.

Combining company and personal funds can wreak havoc on your business’s books. Not to mention, it can be a disaster come tax time.Keeping funds separate with a business https://www.instagram.com/bookstime_inc bank account can help you maintain a better picture of your company’s cash flow and financial standing. A transposition error can cause overspending, inaccurate books, and not paying enough in taxes.

Today, I want to empower you with effective tools for addressing transposition errors. This can have an impact on the income statement and indicate inconsistent and inaccurate financial incorrect records. Moreover, the incorrect information on tax forms, shareholder reports and other accounting documents can give a false perception of fraudulent activities. Transposition errors are unintentional human errors that are common when data is entered manually and referenced from other sources.

Ask Any Financial Question

Transposition errors https://www.bookstime.com/ can have severe consequences in the healthcare sector. For instance, consider a scenario where a patient’s blood test results are wrongly recorded due to a transposition error. The physician may base their diagnosis and treatment decisions on inaccurate information, potentially compromising the patient’s health.

Simple bookkeeping methods and personal reminders can help but the most effective way to detect these errors is with cloud-based data analytics. GLAnalytics is a leading provider of error detection software that will improve the integrity of your financial data, improve processes and save you money. Now that you know what is transposition in accounting, you might wonder where these errors can occur.